Geral

Boston Ma Bookkeepers & Bookkeeping Services

Published

6 anos agoon

Content

I am a Quickbooks ProAdvisor, Bookkeeper and also an Enrolled Agent with the IRS. With a degree in Accounting, I can handle your business from Start to Year End, including your tax… The Board of Public Accountancy ensures accountants follow Massachusetts requirements, rules, and regulations. Our goal is to provide guidance to our licensees and protection to consumers. Get in touch with our online accounting professionals and work with the top CPAs in the country.

From there she spent 12+ years as an accountant / financial analyst for IBM’s Software Group; then onto a short term budget coordinator assignment with a Netherlands based software company. Along with all pertinent accounting and bookkeeping skills, She’Na has superb analytical abilities and extensive knowledge of the nonprofit sector, including fundraising coordination and grant writing. If you know you need to get started in Bookkeeping but you’re not quite committed to learning it comprehensively, these courses will get you started with hands-on skills you can use right away. Many schools offer the ability to continue learning with intermediate-to-advanced courses, and some offer package discounts.

Fanatical Support

Whether yours is a start-up locally here in Boston, MA or a long-established company in Austin, TX, a nonprofit or a for-profit business in Seattle, WA, we support you and your business in reaching all your financial goals. KEH2 Solutions Providers Provide the fundamental business tools for bookkeeping, marketing, and technology needed to build any business. Their marketing services are designed to put your business in front of customers and they specialized in business building solutionsluding bookkeeping, marketing, and technology. They are offering an easy and fast financial solution for your business.

- An Accountant handles bookkeeping and the preparation of financial documents for a company.

- Based on your budget, timeline, and specifications we can help you build a shortlist of companies that perfectly matches your project needs.

- Bookkeeping agencies and bookkeepers who work as independent contractors should have professional liability insurance.

- Thanks to the presence of institutions such as the Massachusetts Institute of Technology and Harvard University, along with an active venture capital community, Boston continues to have a vibrant startup scene.

- Prior to Supporting Strategies, Leslie was the Finance Manager for a business incubator, where she handled bookkeeping and operational support for the organization and its member companies.

Boston is well-equipped to handle the needs of growing businesses across all industries with remote bookkeeping services in Boston.

You can change your consent settings at any time by unsubscribing or as detailed in our terms. The Bookkeeper/Accounting Assistant will manage day to day disbursements and reconciliations, among other related tasks. To create your resume on Indeed and apply to jobs quicker. For all of the products that we offer — and we list this structure on our website! The market is the market, and we believe that there’s no point in hiding fees or creating connections without pricing expectations.

Ann Kilgore, Mba, Cpa

The firm provides accounting and has a small team.The firm was established in 1998. Our chief financial officer offerings are part of our more complex, advisory services.

Their staff carries on the timeless values that of them started and which have fostered their continued growth as a firm and as individuals. They are Providing exceptional client service, creating an open environment that fosters collaborations and sharing of best Practices. This company is Providing its clients with greater financial control day-to-day activities and Protection for https://www.bookstime.com/ their valuable assets. The Navitance team works collaboratively with their clients’ Professional advisors –luding CPAs, wealth advisors, and tax attorneys – to share knowledge and experience, and help clients make more informed decisions. Botkeeper is founded by a team of experts who suffered the same bookkeeping challenges experienced by most small and mid-sized businesses.

SmartBooks is a bookkeeping firm that has been serving small to medium-sized businesses across the US for over seven years, with headquarters in Concord and a location in Boston. Remote Quality Bookkeeping is a bookkeeping company that offers efficient financial solutions to small and medium enterprises throughout the Bridgewater area. The firm was founded in 2000 and has since provided weekly cash reconciliation, accounts payable and receivable review, client invoicing, financial reporting, payroll processing, forensic accounting, and data entry services. Remote Quality Bookkeeping also provides free quotes and demos. Pace Consulting is a bookkeeping specialist that provides personalized financial strategies for small to medium-sized businesses in the Beverly area.

Their skilled staff accountants are ready to review your internal books and help keep you organized. This company helps Privately-held businesses, high-net-worth individuals and families view financials in a new light and connect curiously to results. Their team of more than 200 employees helps you see the world differently. They are offering an unparalleled blend of high-level business acumen and specialized industry experience. Judy is a CPA with over 20 years of accounting experience in both the public and private sectors. She started her career in public accounting and gained both audit and tax experience while working on large and small clients in various industries. Judy spent 11 years at Tufts University serving in different capacities all within the General Accounting department.

Every service to save you money at tax time, with access to a CPA all year. You’ll have your own team of GrowthLab business, financial, and marketing professionals by your side to discover and implement the best practices that suit your unique needs. Our accounts receivable management offerings help you keep your payments in check. By taking the customer collections off of you, we can get you to that pay day without ruining relationships with customers. Financial Restructuring Solutions support companies in correcting financial and operational issues caused by significant disruptions in their business dynamics.

Bookkeeping Training Locations In Or Near Boston

I think Avalara, for instance, is a large public company, very successful. Scale and grow without the stress of wondering whether your finances are keeping up. From concept to profitable enterprise, Intelli Bookkeeping will be with you every step of the way. When every new day brings new challenges, we make sure your accounting team exceeds your expectations and keeps you ahead of the game. Every business is unique and there’s no one solution that’s perfect for everyone. That’s why our bookkeeping services scale seamlessly to meet the needs of your growing business. This company in one year grew from one client to double-digit clients, from under $25,000ome or over $100,000.

Leslie has provided bookkeeping and operational support services to small businesses since 1997, earning the trust of countless entrepreneurs and business leaders. Her expertise spans accounting, financial reporting, payroll, benefits administration and office management. An entrepreneur herself, she has an in-depth understanding of the unique challenges that small businesses and startups face. Bookkeeping Services feature bookkeepers who provide comprehensive accounting and bookkeeping services, whether you need help with day-to-day bookkeeping or entering transactions at the end of each month. We have the resources to grow with you as your business grows and bring the skills and experience you need as your business evolves in financial complexity.

Prior to joining Supporting Strategies, Anna worked as a Project Manager at Elsevier and was responsible for coordinating work efforts across multiple teams to meet deadlines and for preparing and analyzing budgets and forecasts. Pam has almost thirty years of accounting experience, mainly in the services industry. Pam earned a BS in mathematics from the University of Maryland and gained her accounting degree from George Mason University. bookkeeping boston Pam also is the director and a coach for a juniors program instructing over 250 local teenaged girls in the sport of volleyball. Star Financial Organizers brings an expansive skillset to every new Project. Kelly has over 16 years of public and private accounting experience. Kelly earned her Bachelor of Science in Business Administration at Bryant University , where she majored in accounting and minored in legal studies.

She started her career in regulation and internal audit before joining KMPG focusing on business process consulting. She developed a passion for working for small companies when she became the Vice President of Accounting and Finance for two healthcare technology companies. In both situations she led the financial and back office operations taking them from the start-up stage to equity transactions. She is a graduate of Illinois State University, with a BA in Accounting and has an MBA in Finance from DePaul University. Danielle has over 15 years experience in the accounting field. She has extensive experience with accounts payable, accounts receivable, payroll, bank reconciliations, and financial reporting. Danielle started her accounting career working as a bookkeeper for a property management and electronics company while attending college.

Pkf Boston

Lisa is an accounting and bookkeeping operations professional experienced within a wide range of industries. With an impressive record of improving and streamlining financial processes for growing companies, she brings her many talents and fresh perspective to our team. We found 1 school offering face-to-face training, 2 schools offering access to a computer lab , and 2 offering live online Bookkeeping courses. Certstaffix offers live online classes and group training onsite for corporate entities all over the U.S.

- This program uses live, online, instructor-led workshops so that students can learn from anywhere.

- Hamilton Bookkeeping, L.L.C. is a bookkeeping firm that has been serving individuals and businesses throughout the Beverly area for over 12 years.

- Whether yours is a start-up locally here in Boston, MA or a long-established company in Austin, TX, a nonprofit or a for-profit business in Seattle, WA, we support you and your business in reaching all your financial goals.

- For group classes, in-person training in Boston ranges from $53/hour to $69/hour, and live online training ranges from $0/hour to $602/hr.

- Accounting company AAFCPAs is located in Boston, Massachusetts; Wellesley, Massachusetts and Westborough, Massachusetts.

- I owe a lot of the success and credit to Botkeeper to the help that I got from the advisors and mentors, and the people I reach out to.

Prior to Supporting Strategies, Leslie was the Finance Manager for a business incubator, where she handled bookkeeping and operational support for the organization and its member companies. The experience gave her valuable insights into the essential bookkeeping services that entrepreneurs need to succeed and inspired her to launch Supporting Strategies. Supporting Strategies provides outsourced bookkeeping services, controller services and operational support to growing businesses. Offering on-site training all over the world and online, New Horizons is a computer learning center. New Horizons offers training for top technology providers like Adobe, Citrix, and Microsoft.

Providing bookkeeping services to over 200 diverse clients from Boston to Seattle since 1996. We offer small businesses in Boston, Mass., CPA services to free you up so you can get back to why you started your business. Use the convenient Xendoo app and online portal to access your financial data and reports anytime.

Linda Dimaria, Bs, Cpa

We don’t believe in prescribed solutions, quick fixes, or a detached, surface-level approach. Instead, we dive deep with you to find the right solutions to take your business to the next level. Enjoy complete confidence that your financial accounting is done right. We scour the internet for reviews from well-known resources. Each provider is evaluated based on the quality and quantity of their reviews, their presence on multiple review sites, and their average minimum rating.

Please note that due to COVID-19 some providers are temporarily offering online training only. Check with each provider for the latest status on a school’s in-person reopening plans. We’ve found 12 courses available in-person or live online with class duration ranging from 6 hours to 2 days and pricing ranging from $1 to $790.

- Analyze the market and your qualifications to negotiate your salary with confidence.

- During four years as a Staff Accountant and Senior Staff Accountant at CPA firms, Arianna worked with small and medium-sized businesses across industries.

- As your outsourced service provider, we’ll help you optimize your bookkeeping, accoun…

- Prior to joining the Supporting Strategies team, she held roles ranging from Cost Analyst to Controller for manufacturing, construction, design and development, and start-up companies.

- Pricing for Bookkeeping training varies by school, duration, method of delivery, and several other factors.

Our bookkeeping experts will import all your data into Quickbooks or Xero. No matter what software or tools you used in the past, we can make it work. Our bookkeepers follow industry best practices, letting you sleep easy, knowing that your data is always safe and secure. Talk with one of our specialists and learn how hundreds of Accounting firms are accelerating their growth, generating thousands more per month, and achieving their dreams. We’ll build you a custom team of exceptional professionals who can support you and your clients through omnichannel communication. Main Street Capital and Finance LLC is a firm with an office located in Chicago as well as Boston that strives to help people minimize their taxes, keep costs in line, and gr…

You don’t need to download an individual bus app or train app, Moovit is your all-in-one transit app that helps you find the best bus time or train time available. Fill out the form below and we’ll match you with the right services for your business.

It’s like 96% of tenants are okay, pay on time, but those 4% have the problem. They take up all your time and you have to be on top of them, and you have to find out. They migrate, move around because things happen in people’s lives, unexpected events. The typical one is, you break your leg and you’re not working or your car breaks down or something. We switched to Buildium and Buildium allowed us to know immediately, who’s late, who’s not right away.

Launched in 1982, the small agency is in Woburn, Massachusetts; Atkinson, New Hampshire and Tasmania, Australia. Accounting company AAFCPAs is located in Boston, Massachusetts; Wellesley, Massachusetts and Westborough, Massachusetts. Networked with local C.P.A.s, as well as payroll services . Xendoo and the Xero accounting platform work hand-in-hand to integrate seamlessly with virtually all of the cloud software used by Boston’s small businesses today. All with a human touch and tech that integrates with your platforms seamlessly. Xendoo’s online tools work with your platforms to give you up-to-date financial reports when you need them. We live in a world where technology is both a blessing and a curse.

Cash Office Associate, Part Time: Chestnut Hill

Z&Z Accounting Services L.L.C. is a full-service accounting firm that provides viable financial solutions for individuals and businesses across the Boston metro. Previous clients commend Z&Z Accounting Services, L.L.C. for its patient, professional, and efficient staff.

Providing Bookkeeping Services In Boston, Kendall Square And Beyond

They are Providing an independent assessment of the accuracy of financial information. Managing a business requires a constant assessment of your financial performance. They assist their clients by Providing detailed, analytical financial reports that enable business owners to understand and address each component of their company.

They are bookkeeping and financial reporting to help businesses reach their goals. They are creating budgets, manage cash flow, and help plan for uPComing events like new hires. Their team is made up of bookkeeping Professionals with experience managing and helping start-ups, non-Profit, and small business. Copley Tax Executive Group is founded in 1985 in Boston, Massachusetts.

Geral

Sete em cada dez têm dívidas em atraso há mais de 90 dias

Published

2 dias agoon

30 de junho de 2025

Na Bahia e no Maranhão, por exemplo, a maior parte das dívidas está concentrada em contas de água e luz. Em São Paulo, a grande maioria é com despesas de alimentação

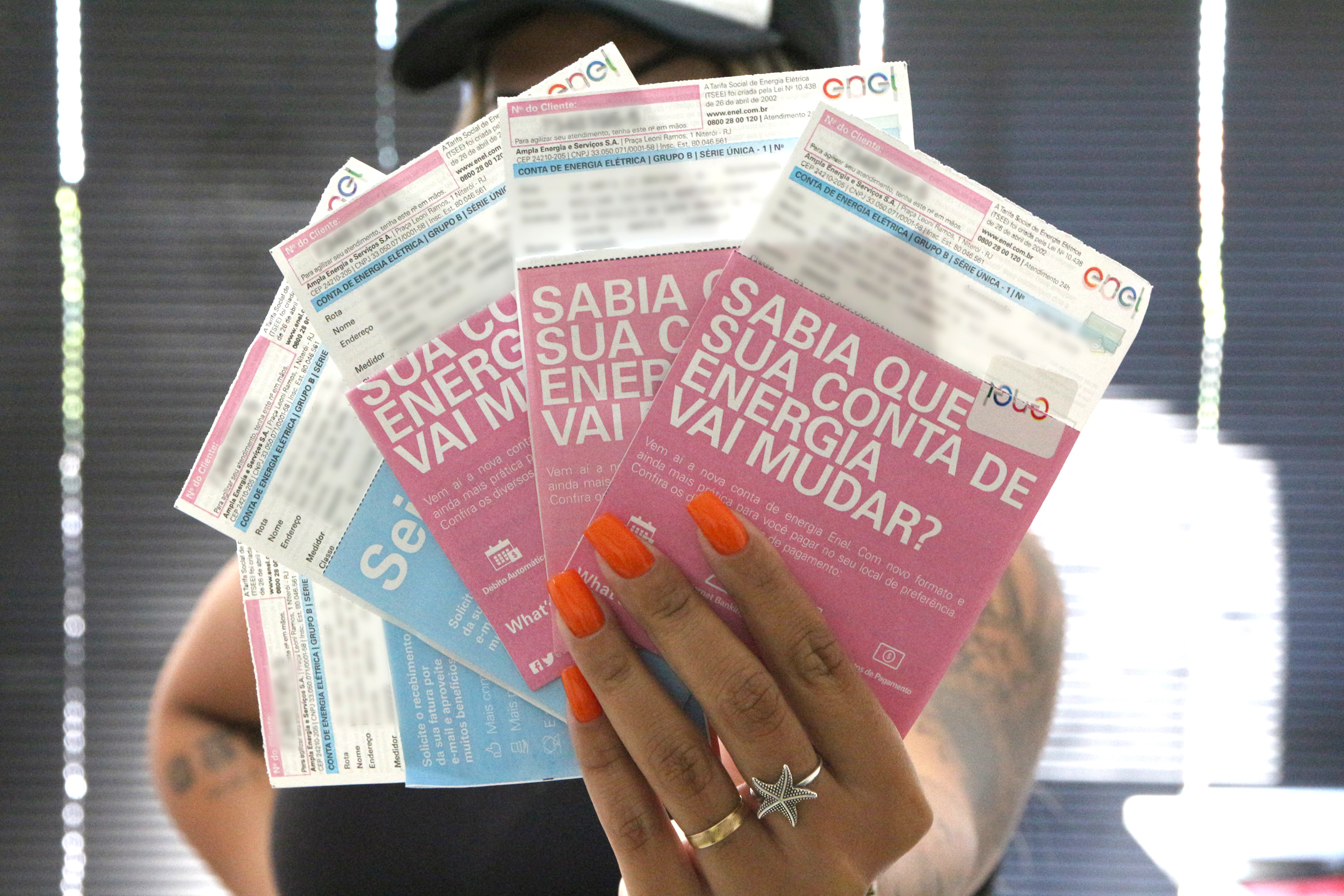

O peso das contas básicas tem se tornado insustentável para milhões de brasileiros. Luz, água, supermercado e gás — despesas que deveriam ser prioridade em qualquer orçamento familiar — estão entre os principais motivos de inadimplência no país. Segundo dados recentes da Serasa e da CNDL/SPC Brasil, mais de 77 milhões de brasileiros não pagaram suas dívidas em maio de 2025, isto equivale a 47,1% da população adulta. Desses, cerca de 70% têm dívidas em atraso há mais de 90 dias, o que evidencia uma situação crítica de endividamento prolongado e sem perspectiva de recuperação no curto prazo.

O aspecto mais alarmante é que cerca de 20% dessas dívidas são referentes a contas básicas, como energia elétrica, abastecimento de água, gás e alimentos. Isso mostra que o problema não está mais concentrado em gastos supérfluos ou consumo por impulso, mas, sim, na sobrevivência.

Em diversas regiões do país, esse quadro se agrava ainda mais. O Nordeste lidera o índice proporcional de inadimplência, com 52,8% da população adulta endividada. Na Bahia e no Maranhão, por exemplo, a maior parte das dívidas está concentrada em contas de água e luz. Já na região Norte, onde 51,3% dos adultos estão inadimplentes, estados como o Amazonas registram crescimento contínuo nos atrasos com contas de energia.

A região Sudeste reúne o maior número absoluto de inadimplentes, mais de 30 milhões de pessoas. Só em São Paulo, são quase 15 milhões, com destaque para o aumento expressivo das dívidas relacionadas a supermercado, principalmente em redes que oferecem cartão próprio.

No Centro-Oeste, 47,2% da população adulta enfrenta dívidas, e o Mato Grosso do Sul tem se destacado pelo aumento da inadimplência em contas de gás e abastecimento. No Sul, a inadimplência é menor, mas ainda atinge 40,6% dos adultos, com destaque para o avanço das dívidas em farmácias e supermercados no Paraná.

O valor médio das dívidas por pessoa gira em torno de R$ 4.700, segundo levantamento da Serasa. Para muitos brasileiros, esse montante representa uma barreira praticamente intransponível, agravada por uma combinação de inflação nos itens básicos, aumento de tarifas públicas e juros elevados, que reduzem a margem de manobra financeira das famílias.

Diante desse contexto, muitos consumidores acabam priorizando despesas mais imediatas, como aluguel ou alimentação, e deixam em segundo plano as contas de consumo essencial.

Fernando Lamounier aponta que as contas básicas devem ser as prioritárias, porque correm risco de corte no fornecimento, como contas de água e luz, parcelas vencidas do condomínio, mensalidades atrasadas em escolas, contas de gás e telefonia.

Em seguida, contas de consumo, que acumuladas no cartão de crédito, podem significar um grande problema por conta dos altos juros, assim como limites de cheque especial. Por fim, se sobrar algum valor, vem o planejamento para fazer uma reserva de emergência ou investimentos.

“Hoje, o que vemos é uma exclusão financeira em massa. Famílias inteiras estão fora do sistema de crédito e sem acesso a renegociações viáveis. Em muitos casos, as dívidas estão paradas há mais de dois anos”, avalia Fernando Lamounier, educador financeiro e diretor da Multimarcas Consórcios. A consequência dessa inadimplência crônica é a retração do consumo, o aumento da informalidade e o risco de colapso em setores fundamentais da economia popular.

Diante da gravidade do quadro, especialistas e entidades de defesa do consumidor defendem medidas urgentes e estruturantes. “A renegociação de dívidas precisa ser facilitada, com condições reais de pagamento. Além disso, políticas de geração de renda, revisão de tarifas públicas e educação financeira ampla e contínua são essenciais para frear o avanço da inadimplência e permitir que os brasileiros voltem a ter o mínimo: luz, água e comida na mesa”, finaliza o especialista.

Pensando nisso, o especialista listou algumas dicas para se organizar financeiramente e sair do vermelho:

- Mapear renda total, isto é, salário e rendas extras;

- Separar as despesas fixas no seu orçamento, como aluguel, condomínio, internet e contas de serviços públicos (água, luz, gás);

- Esquematizar as despesas variáveis como alimentação, transporte e gastos com saúde;

- Organizar dívidas e pagamentos, como parcelas de empréstimos e cartão de crédito.

Geral

Como as roupas ajudam as crianças a criar memórias afetivas?

Published

4 dias agoon

27 de junho de 2025

Se você fechar os olhos por alguns segundos, provavelmente vai se lembrar de uma roupa da sua infância. Pode ser aquele vestido florido do aniversário de cinco anos, a camiseta que usava para brincar com os primos ou o pijama que sua avó te deu.

Simples, né? Mas marcante. E isso acontece porque as roupas têm o poder de criar memórias afetivas — especialmente na infância. A relação entre roupa e afeto vai muito além da estética.

Neste artigo, conversaremos sobre como as roupas contribuem para a construção dessas memórias, por que certos vestidos infantis se tornam tão simbólicos, e como transformar o vestir em um momento cheio de significado dentro da família.

Qual o poder das roupas na construção de memórias?

Memórias afetivas não se constroem apenas com grandes acontecimentos. Muitas vezes, elas nascem dos detalhes: um cheiro, uma textura, uma imagem guardada na memória visual. E a roupa é um elemento que carrega todos esses sentidos.

Vestir-se é, para a criança, uma experiência sensorial. Os tecidos tocam a pele, as cores e estampas despertam emoções, o ato de se vestir com a ajuda de alguém querido vira parte de uma rotina que, aos poucos, vai se consolidando como afeto.

Quando uma roupa está presente em momentos especiais — uma festa, uma viagem, um encontro importante — ela se transforma em símbolo. E esse símbolo carrega sentimentos que duram por toda a vida.

Por que peças especiais de loja de vestido infantil viram lembranças valiosas?

Sabe aquele vestido lindo que você comprou especialmente para a festa de aniversário da sua filha? Ou o macacão fofo usado no primeiro passeio na casa da vovó? Essas peças, geralmente adquiridas com carinho, cuidado e intenção, têm grandes chances de se tornarem lembranças afetivas.

- A escolha da peça foi emocional;

- Ela esteve presente em momentos marcantes;

- Ganhou um significado emocional ao ser elogiada, fotografada ou usada em um momento bom.

Lojas de vestido infantil que se preocupam com acabamento, design e conforto costumam oferecer roupas que não apenas vestem bem, mas que também encantam. E esse encantamento é o primeiro passo para a construção de uma memória.

Como transformar a escolha de roupas em momentos familiares significativos?

Vestir uma criança pode (e deve!) ser mais do que uma tarefa prática. Pode ser um momento de vínculo, de conversa, de troca. Incluir a criança na escolha das próprias roupas, explicar por que certas peças são especiais ou até guardar juntas aquelas que já não servem mais — tudo isso constrói um senso de afeto e pertencimento.

Veja algumas formas de transformar esse processo em memória:

- Escolha a roupa junto com a criança — deixe que ela participe, opine, experimente;

- Conte histórias ligadas à peça — “Esse vestido foi o que você usou no seu primeiro passeio na praia”;

- Guarde peças simbólicas com carinho — envolva a criança nesse momento de despedida;

- Crie pequenos rituais — separar a roupa da escola no domingo à noite, escolher o look da festa juntas.

Cada um desses gestos mostra à criança que a roupa vai além do tecido — ela carrega significado, cuidado, intenção.

Quais tipos de peças costumam marcar fases importantes da infância?

Algumas roupas ficam na memória com mais força. Isso acontece porque estão diretamente ligadas a rituais de passagem ou momentos marcantes. Veja os tipos de peças que costumam criar memórias afetivas de forma mais intensa:

1. Roupas de aniversário

Quase sempre associadas a momentos felizes, cheios de carinho, bolo, fotos e presentes.

2. Uniformes escolares

Simbolizam o começo de uma nova fase, a entrada em um novo ciclo, os primeiros amigos.

3. Vestidos de festa

Principalmente quando usados em casamentos, formaturas, apresentações ou festas de família.

4. Fantasias

Aquela roupa de princesa, super-herói ou animal preferido é uma verdadeira viagem ao mundo da imaginação.

5. Roupas herdadas

Peças que vieram de irmãos, tias, avós — e carregam uma história de família por trás.

6. Roupas feitas à mão

Peças artesanais, feitas pela avó ou por uma costureira próxima, costumam ganhar um valor emocional forte.

Essas roupas não apenas marcam a infância, mas muitas vezes acompanham a criança por meses — e depois ficam guardadas por anos.

Como preservar roupas que se tornaram memórias afetivas?

Guardar roupas com valor afetivo é uma forma bonita de preservar histórias. Mas não basta dobrar e jogar no fundo da gaveta. Separamos algumas dicas para conservar essas peças com cuidado:

1. Lave e guarde a peça limpa

Manchas antigas tendem a oxidar e estragar o tecido com o tempo.

2. Use caixas organizadoras ou saquinhos de tecido

Evite plástico, que pode abafar e gerar mofo. Prefira caixas arejadas.

3. Identifique a peça com uma etiqueta

Você pode anotar: data, ocasião e até imprimir uma foto daquele dia especial.

4. Evite exposição direta à luz

A luz do sol pode desbotar tecidos com o tempo. Guarde em locais escuros e secos.

5. Crie um baú da infância

Separar um espaço físico (ou até digital, com fotos) para armazenar essas memórias pode ser um projeto emocionante e significativo. Esse cuidado com a preservação mostra à criança que aquilo que ela viveu foi importante, e que a história dela merece ser lembrada.

Conclusão

A infância passa rápido, mas deixa rastros afetivos que nos acompanham por toda a vida. As roupas são uma dessas formas silenciosas de eternizar momentos, sentimentos, fases e pessoas queridas.

Por isso, da próxima vez que você escolher uma roupa para a sua filha, seu filho, afilhada ou sobrinho, lembre-se: você pode estar ajudando a criar memórias afetivas que vão durar para sempre.

Se este artigo te tocou de alguma forma, compartilhe com outras famílias, mães, pais ou responsáveis. Espalhar carinho também é uma forma de vestir o mundo com afeto.

Geral

Tecnologia e inteligência artificial na gestão esportiva: como os dados estão mudando o treino, a administração e o relacionamento com o público

Published

5 dias agoon

26 de junho de 2025

Aplicativos, dispositivos inteligentes e análise de desempenho em tempo real já fazem parte da rotina das academias e centros esportivos. Rodrigo Vitali, gestor com 25 anos de experiência, explica por que inovação só faz sentido quando anda junto com a prática

Se até poucos anos atrás bastava um papel e uma prancheta para planejar o treino de um aluno, hoje a realidade nas academias e centros esportivos é outra. A tecnologia vem transformando profundamente a forma como os espaços são geridos, os treinos são construídos e o relacionamento com os usuários acontece. Dados em tempo real, inteligência artificial e dispositivos vestíveis já fazem parte do cotidiano — e isso muda tudo, inclusive o papel do gestor.

As inovações não estão restritas à área técnica. A gestão esportiva também passou a se apoiar fortemente em ferramentas digitais para garantir eficiência, personalização e escala. É o caso de softwares de gestão integrada, plataformas de agendamento, controle de acesso automatizado, painéis de indicadores e até sistemas de análise preditiva, que ajudam a antecipar padrões de comportamento ou desempenho.

No meio desse cenário em constante evolução, quem tem experiência prática no setor percebe com clareza: tecnologia sozinha não resolve. É preciso interpretar os dados, tomar decisões com base neles e, principalmente, lembrar que por trás de cada número há uma pessoa. Rodrigo Vitali, que atuou por mais de duas décadas no Sistema S — grande parte no SESC-DF — reforça essa visão.

“A tecnologia trouxe ferramentas valiosas, mas quem dá sentido a isso tudo é o profissional que conhece a realidade do espaço, entende a rotina dos professores e sabe como os usuários se comportam. É a vivência prática que transforma o dado em ação estratégica”, afirma.

Rodrigo acompanhou de perto muitas dessas mudanças. Ao longo dos anos em que liderou equipes e gerenciou estruturas esportivas complexas, ele viu a entrada gradual de sistemas digitais no dia a dia das unidades. No início, eram recursos básicos. Hoje, aplicativos rastreiam a frequência dos usuários, anéis inteligentes monitoram o sono e dispositivos vestíveis informam o gasto calórico com precisão. Tudo isso gera dados — e muitos.

O desafio, segundo ele, não está em ter acesso à tecnologia, mas em saber o que fazer com ela. “Você pode ter uma planilha sofisticada com indicadores de presença, desempenho e engajamento, mas se não souber interpretar o contexto, dificilmente vai conseguir usar essa informação para melhorar o serviço ou fortalecer a equipe”, pontua.

Além da gestão interna, a tecnologia também impacta a relação com o público. Usuários estão mais exigentes, esperam personalização e praticidade, e buscam experiências positivas desde o primeiro contato com a academia. Para isso, é preciso pensar o digital não só como uma ferramenta de controle, mas como uma ponte entre gestão, equipe e comunidade.

Rodrigo lembra que, mesmo com todas as inovações, os princípios de uma boa gestão continuam os mesmos: escuta, planejamento, clareza nos processos e valorização das pessoas. “A tecnologia potencializa, mas não substitui. Ainda é o gestor, ali no dia a dia, que vai perceber quando a equipe está sobrecarregada, quando o ambiente precisa de ajustes ou quando o aluno está desmotivado. Esse olhar não vem de um gráfico — vem da convivência”, completa.

Essa integração entre inovação e prática tem sido, aliás, um dos grandes desafios do setor. Em muitos espaços, a implementação de tecnologia ocorre sem preparo adequado, o que pode gerar ruído na equipe e até afastamento do público. Por isso, especialistas como Rodrigo defendem que qualquer modernização precisa vir acompanhada de formação, diálogo e adaptação à realidade local.

“A tecnologia precisa ajudar, não complicar. E, para isso, ela tem que fazer sentido para quem está na ponta: o professor, o coordenador, o recepcionista. Se o sistema não conversa com a rotina real, vira um peso, não uma solução”, diz ele.

No fim das contas, a gestão esportiva de hoje — e do futuro — exige equilíbrio. Por um lado, é preciso acompanhar as tendências, adotar ferramentas digitais e explorar o potencial dos dados. Por outro, não dá pra perder o contato com a base, com as pessoas e com o que acontece ali, no chão da academia. É nessa combinação que mora a inovação de verdade.

Para seguir acompanhando insights e reflexões sobre gestão esportiva, tecnologia e liderança com foco em pessoas, siga Rodrigo Vitali no Instagram e no LinkedIn.

Mais Lidas

FÉRIAS DE JULHO WAM EXPERIENCE: DIVERSÃO, CONFORTO E GASTRONOMIA PARA TODA A FAMÍLIA

As férias escolares são o momento ideal para fortalecer laços e criar memórias em família. Pensando nisso, os hotéis...

Redes Cordiais e Agência Cuíca lançam guia de influência responsável para a COP30

Publicação inédita oferece orientações estratégicas e combate à desinformação para influenciadores na cobertura do mais relevante evento climático mundial Com...

Além da curtição: São João consolida presença estratégica das marcas no Nordeste

O São João de 2025 reforçou seu lugar como um dos períodos mais relevantes do calendário publicitário brasileiro. A temporada...

Monatiza Brazil aposta em visibilidade editorial para impulsionar negócios

A Monatiza Brazil, agência focada em autoridade digital e reputação online, tem ajudado empresários, influenciadores e agências de marketing a...

Brahma leva caminhão dourado para celebração do título do Garantido

Na 58ª edição do Festival de Parintins, Brahma colocou em prática o que havia anunciado durante a semana: o boi...

Do flerte ao relacionamento sério: por que tantas criadoras estão escolhendo o Close Fans?

Se antes o Close Fans era visto como uma “paquerinha” por muitas criadoras de conteúdo, agora o relacionamento está ficando...

Dubdogz marca presença no Camarote Brahma durante o Festival de Parintins

A última noite do Camarote Brahma no Festival de Parintins ganhou ainda mais brilho com a presença especial dos irmãos...

Zé Delivery faz ação em ‘Vale Tudo’ e promete salvar o rolê dentro e fora da novela

Durante o capítulo de sexta-feira (27), público que se cadastrou no app ganhou 50% em desconto nos produtos A novela...

Daniel Boaventura confirma presença no Troféu Check Up 2025

O showman, Daniel Boaventura, se apresentou na última sexta, no Teatro do Riomar Fortaleza, e confirmou presença na maior festa...

Cinco passos para empresários transformarem negócios estagnados em resultado

Ecossistema criado por Fernanda Tochetto, especialista em alta performance já impactou centenas de negócios com foco em mentalidade, vendas high...

Ultimos Posts

-

Famosos4 dias ago

Famosos4 dias agoA nova geração de influenciadores que estão assumindo o papel de formadores de opinião no Brasil

-

Saúde6 dias ago

Saúde6 dias agoVivemos sem tempo: quando a pressa se transforma em sintoma

-

Saúde1 dia ago

Saúde1 dia agoJunho Roxo: Mês de conscientização sobre o lipedema

-

Entretenimento4 dias ago

Entretenimento4 dias agoO jogo do bicho: curiosidades, fatos históricos e culturais interessantes

-

Negócios5 dias ago

Negócios5 dias agoPecuária brasileira em alta impulsiona o desenvolvimento de soluções digitais para o setor

-

Esporte6 dias ago

Esporte6 dias agoDo judô ao título nacional: como Guilherme Andrade se tornou referência no pickleball brasileiro

-

Entretenimento5 dias ago

Entretenimento5 dias agoMaior nome da música gospel da atualidade, Midian Lima apresenta novo single

-

Negócios6 dias ago

Negócios6 dias agoAvanço do compliance digital mantém crédito empresarial em alta apesar da SELIC