Geral

Simple Bookkeeping Tips For Entrepreneurs

Published

6 anos agoon

Content

- #7 Understand Your Bookkeeping Reports

- Separate Your Personal And Business Bank Accounts

- Business Resources

- Engage In Disaster And Data Recovery Planning

- Build Accounting Into Your Work Schedule

- Perform Regular Financial Checkups

- Separate Receivable Payments From Borrowed Loans

- Streams Of Income That Will Grow Your Wealth

Always ensure that you have all the bank and credit card statements, profit and loss statements, balance sheets, receipts and invoices for sales and services rendered by the business. This will enable you to establish a good financial ground for your business even when it expands.

If you have too many cooks in the kitchen, sometimes things get done twice. You end up with a lot of confusion about where one person’s job ends and where the other begins. That will help clarify the expectation and create accountability. Staying on top of the admin will alleviate stress, a much-needed relief for most business owners, and prepare you for those unexpected surprises that are around every corner.

#7 Understand Your Bookkeeping Reports

Many Canadian banks currently offer cheap business accounts, where for just $5 per month, you have enough to start, and you can upgrade your account when your business grows. Blake Bobit has been an entrepreneur and business owner for over 25 years. He founded Solution Scout to provide the most helpful answers to questions about business solutions. Blake provides strategic advisory services to businesses in many industries nationwide and is passionate about helping others reach new levels of success. While business owners are accustomed to having to wear many hats, there is a point beyond which no amount of persistence or enthusiasm will help, especially when it comes to bookkeeping. Most bookkeeping services will have a deadline to send the previous month’s reports (example by mid-February they send the January statements).

- Bookkeeping software helps you prepare these financial reports, many in real-time.

- First, that’s the only way you can get a real sense for your company’s financial health.

- Keeping your records up-to-date is essential to running your business.

- When you track and categorize your expenses and revenue streams, you and your financial advisors will be able to identify different areas of strength or growth based on historical data.

- For example, many business expenses, like store or office rent, are tax-deductible.

This way, you can correct mistakes before they start costing you serious money. Also, you’ll likely get cheaper rates since many services are looking to maintain consistent income during their off-season. Making sure that your financial records are backed up in the event of a natural disaster or cyberattack are key to keeping your business running smoothly. If you lose your records, you might not be able to take advantage of some important tax deductions. By recognizing the bookkeeping tips above, your business can rest assured that the books will no longer be a massive burden to bear.

Separate Your Personal And Business Bank Accounts

It would help if you considered organizing all your paper records with proper labelling and using different sorting strategies. Whatever your business, there will always be the possibility of a piece of equipment needing to be replaced, a large inventory order, or some other big-ticket purchase. Planning for major expenses enables you to meet them without panic and with sufficient means to comfortably cover them without having to divert funds from other areas of your business.

- A cloud-based bookkeeping system can also save physical space—a significant benefit when considering the IRS recommends businesses store financial records for at least 3 years.

- From the cash you have on hand to the debts you owe, understanding the state of your business’s finances means you can make better decisions and plan for the future.

- Whether it’s on a company credit card, debit account, by cheque or a cash payment, keep a record of those transactions.

- Quick, regular audits of your documentation and transactions will ensure that you’ll never have a stressful night’s sleep—at least as far as your books are concerned.

- This may influence which products we review and write about , but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research.

Some entrepreneurs believe that once they’ve sent out an invoice, they’ve taken care of billing. “Every late payment is an interest-free loan and hurts your cash flow.” Additionally, Mari says, routinely jot down business trips, lunches, coffee dates and other events with cash outlays in your electronic or paper day planner. This habit can go a long way toward substantiating those items for your tax records in the event of an audit. But when you don’t have a system and some processes in place, unpleasant surprises can pop up, goals can be easily missed and important paperwork forgotten. Getting a better handle on your money can help you to make and keep long-term goals, smooth out the seasonal ups and downs of your cash flow and maybe improve your profits.

An accountant will provide you with information about your financial status anytime you want it. A professional accountant makes sure that all the information and data you have is accurate and can generate interim reports for you. When you sign-up with Bench, you’ll get an easy-to-use platform and direct access to your in-house small business bookkeeping team. The return on investment with a dedicated bookkeeper may surprise you. Plus, when tax season rolls around, you can take comfort in knowing your financials are 100% correct and ready to be handed off to your accountant. If you don’t carry a receipt book with you everywhere you go, you can always rely on technology. Keep track of your cash using cloud software that links through multiple devices, like your phone or laptop.

Business Resources

Running a business is an exciting, but demanding opportunity. As an owner, you are responsible for ensuring that your financial records are complete and accurate. If you need help keeping your records up-to-date, the specialists at Valley Business Centre offer quality bookkeeping and payroll services. Staying on top of your accounts receivable will help the cash flow of your business. Customer who pay late can drag a business down, making it difficult to pay bills. By monitoring your accounts receivable, you can address slow-paying customers before they become collection problems. In some cases, you may need to work out a payment arrangement.

When you keep accurate records and track your data, you’ll have a better idea as to your upcoming tax obligations. You can set aside the money for your tax obligations a little at a time or file a timely extension request. If you can tolerate the missed dinners, late nights, and lack of sleep, your dedication will surely help you cut expenses and accumulate cash. Instead of paying professionals to do your https://www.bookstime.com/ small business bookkeeping, you can put your money to work buying products and materials and paying your workers to produce more goods to sell. Eventually, the money you save will help your business grow a little at a time. However, it is advisable to consult a trained accountant before buying any accounting software. This is due to the fact that some are very complicated and might be difficult to use.

Some software packages integrate with bookkeeping software, making your payroll process even more efficient. Most credit card statements categorize your expenses, so you can see where your money went.

Engage In Disaster And Data Recovery Planning

You will enjoy a more streamlined record-keeping process due to identifying taxable benefits and deductions quicker and more efficiently. This material has been prepared for informational purposes only, and is not intended to provide, and should not be relied on for, financial or accounting advice. You should consult your own accounting advisors before engaging in any financial transaction. By entering your email to be included on Fundid’s waitlist, you are under no obligation to obtain any products or services from Fundid. Full terms and conditions will be provided at the time of account opening. Fundid is driven by a mission to empower business owners on their growth journeys by simplifying business finance and access to capital. Fundid is driven by a mission to empower business owners on their growth journeys by simplifying business finance & access to capital.

You don’t schedule that physical because you’re aware of some pressing issue. Your doctor will take a look at a few things, ask probing questions, then notice some areas for improvement. They might ask you to exercise a little bit more, start taking iron supplements, or keep a close eye on how your throat feels. But taking stock of things helps them figure out what you need to adjust, and from there, they can create a game plan to improve your overall health. GoCardless is authorised by the Financial Conduct Authority under the Payment Services Regulations 2017, registration number , for the provision of payment services. New projects, budget for the year ahead, and determine whether clients have paid invoices. When it comes to youraccounts receivablesand collections, when getting financing throughinvoice factoringat Liquid Capital, our team will also take care of that portion for you.

5) Establish business credibility and professionalism – You always want to ensure your business is credible in the eyes of the public, lenders, creditors, and everyone else. Keeping personal and business accounts separate demonstrates that you can be trusted by suppliers and clients.

Build Accounting Into Your Work Schedule

Now, even a small error or oversight can impact your P&Ls,Income Statement, revenue projects — and snowball into a big end-of-year mistake that affects your payroll and taxes. So save your money, time and maybe even some gray hair by establishing an easy-to-follow bookkeeping process. If you’re not using the Business Toolkit you’ll need to make sure that all your bank transactions are reflected in your bookkeeping system. Match the transactions to the necessary invoices, bills and receipts . While it’s not fun to hold onto every little receipt and track all transactions, you will be making things easier for your business. It will also benefit your business once tax time rolls around.

This reconciliation is how they know that all the transactions have been recorded at the proper amount. With a separate business account, you can maintain accurate records and prevent spending excess time identifying and removing personal expenses from your financial reports. All of your incoming payments and outgoing expenses are easily recorded in one place. This creates a more efficient accounting process, particularly when tax season rolls around. Plus, by opening separate accounts, your personal assets are protected in the event of an audit or lawsuit. One of the most important bookkeeping tips to ensure accurate and easy-to-process expense reports is to separate your business finances from your personal finances. If you haven’t already, consider opening a separate bank and credit card account for your small business, rather than operating out of your personal accounts.

But you should also consider putting away a little something when you can, to build a fund for those unexpected events. It’s no doubt that cash flow can be a problem for small businesses. Similarly, an accurate representation Bookkeeping Tips of your current bookkeeping will allow you to forecast realistic financial goals for your business to hit over the next quarter or year. Here are ten tips to make small business bookkeeping easier.

Even if you have a bookkeeper tracking your finances, you must still know what’s going on with your money. As your business grows, it may be time to hire a service to manage your books. If you’re considering this route, check with other business owners for recommendations on the services they use. Many applications connect with your business’s checking account so you don’t have to manually record entries. Whether you are an independent contractor or a multinational corporation, bookkeeping is important to you. With a budget, you are better equipped to plan for future expenses.

Separate Income And Non

Paper documents are often cumbersome, messy, and inconvenient. The longer you’re in business, the more storage space you need to accommodate your snail mail invoices, bills, and other documents. Paper is also easily destroyed by water, fire, and other hazards. When you digitize your records, you can save space and synchronize bills, invoices, and receipts with your digitized bookkeeping accounts.

- If you’re considering this route, check with other business owners for recommendations on the services they use.

- If you know you’re likely to put it off, push it to the top of your to-do list and get it done first thing in the morning.

- Basically, cash accounting recognizes revenue and expenses right away, while accrual accounting places focus on the anticipated revenue and expenses.

- To enable your business to run smoothly, you should keep a close eye on all money coming in .

- Accounting for your cash transactions doesn’t have to be difficult.

- To get the most out of your software, you should work with a bookkeeping professional to make sure it’s set up correctly.

It’s easy to mix your personal and business expenses when you carry multiple credit or debit cards. You can pull out the wrong credit card while buying lunch, filling your gas tank, or paying for supplies. You can charge a business expense to your personal account with the intention of straightening it out later.

Avoid legal problems that sometimes come with a joint account and simplify your life by splitting up business and personal finances. This is something that is especially important for C corporations. Simplify, automate, and ultimately delegate your bookkeeping.

Separate Receivable Payments From Borrowed Loans

With everything else you’re juggling as a small-business owner, it’s tempting to keep postponing your books. After all, you’re in business because of your proficiency in your field, not because you enjoy bookkeeping . Accounting software can sometimes be exceedingly difficult to operate and complicated, especially if you do not know what you are doing.

You will be able to track down and analyze any issues that may arise. Another way to track all the expenses and income generated by the business is to have a business credit card since it keeps a record of all the expenses. Furthermore, it refrains you from using cash and thus losing receipts will be a thing of the past. As a small business owner, one of the most vital things you should practice is the aspect of bookkeeping. If you have good financial records, you will be able to manage debts, deposits, and items given on credit by using invoices recorded. Without proper management of all your business finances, you may end up bankrupt before your investment even expands. Bookkeeping is important because accurate accounting records are essential to a company’s sustainability.

Streams Of Income That Will Grow Your Wealth

Fixed costs are the costs that either don’t change or you have no control over the change. This includes your rent or mortgage, equipment costs, insurances, permits, and other operational expenses. These fixed costs typically make up the minority of your restaurant expenses. “Excellent and professional work helping with our business and personal legal and estate planning needs.” You’ll also make it easier to get your questions answered when you’re trying to track down that one specific transaction a few months later. Providing a set date can be crucial to getting paid on time. The UK average is 30 days to pay but you can ask for payment sooner, or even later.

Geral

LIDE promove debate sobre o cenário político brasileiro com presença estratégica do Grupo Sogno

Published

20 minutos agoon

24 de fevereiro de 2026

O evento “Cenários do Brasil”, realizado no Hotel W em São Paulo, reuniu lideranças empresariais como o grupo SOGNO e o presidente nacional do PT, Edinho Silva, para um diálogo franco sobre o futuro econômico e político do país.

Sob a liderança do ex-governador João Doria, o LIDE (Grupo de Líderes Empresariais) deu início à série de encontros “Cenários do Brasil” na última segunda-feira, dia 9, com um almoço exclusivo no Hotel W. O evento, que reuniu cerca de 400 empresários e 24 veículos de imprensa, teve como convidado central Edinho Silva, presidente nacional do PT, em um diálogo franco sobre o futuro econômico do país. Neste ambiente de alta cúpula, a presença de Kleber Almeida, CEO do Grupo Sogno, foi estratégica: convidado pela organização para contribuir com sua expertise em reestruturação de negócios, Almeida reforçou o papel da consultoria como pilar essencial na interface entre o setor produtivo e a estabilidade institucional.

Neste contexto de busca por equilíbrio institucional e eficiência econômica, a presença do Grupo Sogno se destacou. Convidado diretamente pelo LIDE, o grupo — representado por seu CEO, Kleber Almeida — foi demandado para a discussão justamente por sua expertise em reestruturação de negócios e inteligência financeira.

Kleber Almeida | CEO do Grupo SOGNO – Foto: Divulgação

A visão estratégica do Grupo Sogno

Em um momento em que o mercado busca entender as nuances das políticas públicas e seu impacto direto no setor produtivo, a consultoria especializada do Grupo Sogno torna-se um pilar de sustentação para empresas em transição. Kleber Almeida, cuja trajetória de transformar desafios de recuperação judicial em um ecossistema financeiro robusto foi recentemente destaque na Forbes Latina, reforçou durante o encontro a importância de uma gestão técnica e resiliente.

O Grupo Sogno tem se consolidado como uma das empresas pilares na SP Negócios, figurando como a única consultoria presente na agência de promoção de investimentos da cidade, o que reitera sua relevância na estruturação de negócios que impulsionam a economia paulista.

Próximos passos: Wellness e Gestão Pública

O diálogo entre o setor empresarial e o poder público continua. O próximo encontro já tem data marcada: dia 26 de fevereiro, na Casa LIDE, na Faria Lima. O seminário LIDE Wellness e Qualidade de Vida contará com a presença do prefeito de São Paulo, Ricardo Nunes, para discutir estratégias que unem o desenvolvimento econômico ao bem-estar e à qualidade de vida na metrópole.

A participação contínua do Grupo Sogno nestes fóruns reforça o compromisso da consultoria em não apenas acompanhar as mudanças do mercado, mas em ser um agente ativo na construção de um ambiente de negócios mais seguro e próspero no Brasil.

Entre em contato com o Grupo SOGNO: https://sognobr.com/

Geral

O que fazer se um pedido de um site internacional demorar ou não chegar?

Published

2 horas agoon

24 de fevereiro de 2026

Compras em sites internacionais tornaram-se cada vez mais comuns, impulsionadas por preços competitivos e pela grande variedade de produtos disponíveis. A possibilidade de encontrar itens exclusivos ou com valores mais baixos faz com que muitos consumidores recorram a esse tipo de comércio com frequência.

Ainda assim, situações como atrasos prolongados ou a não entrega do pedido podem gerar frustração e insegurança, especialmente quando não há informações claras sobre o status da compra. Esses imprevistos costumam levantar dúvidas sobre prazos, responsabilidades e quais medidas podem ser adotadas para resolver o problema.

Compreender quais passos seguir nessas situações ajuda a resguardar direitos e aumenta as chances de alcançar uma solução adequada. Além disso, otimiza o uso de recursos como os cupons AliExpress, assegurando uma experiência de compra mais consciente, mesmo diante de eventuais imprevistos no processo de entrega.

Verifique o prazo de entrega estimado antes de se preocupar

Antes de qualquer ação, convém checar o prazo de entrega informado no momento da compra, já que pedidos internacionais podem levar semanas ou até meses, dependendo do país de origem e do método de envio escolhido. Plataformas como AliExpress e Amazon costumam exibir essa estimativa tanto na finalização do pedido quanto na área de acompanhamento.

Manter um registro dessa informação, por meio de anotação ou captura de tela, facilita consultas futuras caso surjam dúvidas. Se o prazo ainda estiver em vigor, o mais indicado é aguardar, acompanhando o status periodicamente para evitar preocupações desnecessárias diante de atrasos comuns em envios internacionais.

Rastreie seu pedido para identificar possíveis problemas

O rastreamento do pedido oferece dados relevantes sobre o trajeto da encomenda, indicando, por exemplo, se o pacote está parado em centros de distribuição, retido na alfândega ou se ocorreu algum erro logístico. A maioria dos sites internacionais fornece um código que pode ser consultado em plataformas como os Correios ou em serviços especializados de rastreio.

Acompanhar as atualizações com frequência e observar períodos longos sem movimentação ajuda a identificar sinais de problema. Essas informações podem acelerar a busca por uma solução e servir como comprovação caso seja necessário abrir uma reclamação formal na plataforma de compra.

Entre em contato com o vendedor para esclarecimentos

Quando o pedido ultrapassa o prazo esperado ou não apresenta atualizações relevantes, a comunicação direta com o vendedor tende a ser um caminho inicial. Muitas plataformas contam com sistemas internos de mensagens, que permitem questionar o andamento do envio ou relatar eventuais inconsistências.

Mensagens claras, com o número do pedido e uma descrição objetiva da situação, facilitam o entendimento e a resposta do vendedor. Um tom educado costuma contribuir para desfechos positivos, que podem incluir explicações detalhadas, reenvio do produto ou até um reembolso parcial.

Abra uma disputa no site para proteger seus direitos

Caso o contato com o vendedor não resulte em solução ou o período de proteção da compra esteja próximo do fim, a abertura de uma disputa na própria plataforma torna-se uma alternativa relevante. Sites como o AliExpress contam com políticas de proteção ao comprador que permitem solicitar reembolso ou substituição do item não recebido.

Para fortalecer a solicitação, é indicado reunir evidências, como registros de rastreio e conversas mantidas com o vendedor. Agir dentro dos prazos estabelecidos pela plataforma aumenta a segurança na recuperação do valor pago e reduz o risco de prejuízos financeiros.

Considere os trâmites alfandegários e taxas extras

Outro fator que pode causar atrasos é a retenção do pedido na alfândega, situação relativamente comum em compras internacionais. Em determinados casos, há cobrança de taxas de importação ou exigência de documentação adicional para o pacote ser liberado.

A verificação de notificações nos sites dos Correios ou da Receita Federal ajuda a identificar rapidamente essas pendências. Ignorar essas etapas pode resultar na devolução do produto ao remetente, sendo necessário ter atenção aos trâmites para evitar perdas e acelerar a entrega.

Previna problemas futuros com escolhas mais seguras

Por fim, algumas práticas reduzem significativamente os riscos em compras internacionais, como priorizar vendedores bem avaliados e optar por métodos de envio que ofereçam rastreamento completo. A leitura atenta das avaliações de outros compradores e a checagem da reputação da loja fornecem indícios importantes sobre a confiabilidade do vendedor.

Plataformas reconhecidas por oferecerem proteção ao consumidor também tendem a proporcionar maior segurança. Essas escolhas tornam a experiência de compra mais previsível e confiável, diminuindo as chances de atrasos prolongados ou extravios em pedidos futuros.

Geral

Reforma de apartamento: por onde começar para evitar dores de cabeça

Published

3 horas agoon

24 de fevereiro de 2026

Reformar um apartamento pode valorizar o imóvel, melhorar o conforto e até reduzir custos de manutenção no longo prazo. O problema é que muitas obras começam sem planejamento adequado e acabam gerando atrasos, gastos extras e bastante estresse.

Seja uma pequena reforma ou uma intervenção mais ampla, o sucesso depende de organização, escolha correta de fornecedores e decisões técnicas bem pensadas. Neste guia, você vai entender por onde começar para conduzir sua reforma com mais segurança e previsibilidade.

Como planejar uma reforma eficiente desde o início

Um dos primeiros passos é mapear exatamente o que precisa ser feito. Muitas pessoas começam a obra com uma ideia geral, mas sem detalhamento. Isso costuma gerar mudanças no meio do caminho, que quase sempre encarecem o projeto.

Ao estruturar o planejamento, é comum que proprietários pesquisem fornecedores locais, incluindo vidraçarias em Campinas, marcenarias, eletricistas e outros profissionais. Esse levantamento prévio ajuda a ter noção real de custos e prazos antes mesmo de iniciar a obra.

Um bom planejamento inclui:

- definição clara dos ambientes que serão reformados

- levantamento de medidas e condições atuais

- estimativa de orçamento com margem de segurança

- cronograma preliminar da obra

- verificação das regras do condomínio

Quanto mais detalhada for essa etapa, menores serão as chances de surpresas desagradáveis.

Pequena reforma ou reforma completa: como decidir?

Nem sempre é necessário fazer uma obra grande para obter bons resultados. Muitas vezes, pequenas intervenções já transformam bastante o ambiente.

A decisão depende principalmente de três fatores:

Primeiro, o estado atual do imóvel. Se a estrutura elétrica e hidráulica está antiga, pode ser mais inteligente aproveitar e fazer uma atualização mais ampla.

Segundo, o objetivo da reforma. Quem pretende vender ou alugar pode focar em melhorias visuais e funcionais com melhor custo-benefício.

Terceiro, o orçamento disponível. Reformas completas exigem reserva financeira maior e maior tolerância a imprevistos.

Avaliar esses pontos com calma evita começar uma obra maior do que o necessário.

Quais etapas não podem faltar em uma obra residencial

Mesmo em reformas pequenas, existe uma sequência lógica que ajuda a evitar retrabalho. Ignorar essa ordem é um erro comum.

Normalmente, a obra segue este fluxo:

Primeiro vêm as demolições e adequações estruturais. Depois entram elétrica e hidráulica. Em seguida, revestimentos, pintura e, por fim, acabamentos e marcenaria.

Respeitar essa ordem evita situações como quebrar parede já pintada ou refazer piso recém-instalado.

Outro ponto importante é garantir que todos os materiais principais estejam definidos antes do início. Mudanças de última hora costumam afetar o cronograma.

Como controlar o orçamento da reforma

Estouro de orçamento é uma das maiores queixas de quem reforma. Isso acontece, na maioria das vezes, por falta de previsão de custos indiretos.

Algumas estratégias ajudam a manter o controle:

Definir um teto máximo antes de começar.

Separar uma reserva de contingência, geralmente entre 10% e 20%.

Evitar mudanças estruturais durante a execução.

Comparar orçamentos de diferentes fornecedores.

Acompanhar semanalmente os gastos da obra.

Ter uma planilha simples de controle já faz bastante diferença.

A importância de escolher bons profissionais

Mesmo uma reforma pequena pode dar problema se a mão de obra não for qualificada. O barato, nesse caso, costuma sair caro.

Antes de contratar, vale verificar:

- portfólio de trabalhos anteriores

- avaliações de clientes

- clareza no orçamento apresentado

- prazo de execução

- forma de acompanhamento da obra

Profissionais organizados costumam apresentar escopo detalhado e cronograma básico. Isso já é um bom sinal.

Reformas rápidas que valorizam o imóvel

Para quem quer melhorar o imóvel sem grandes intervenções, algumas ações costumam gerar bom impacto visual.

Troca de iluminação por modelos mais modernos.

Atualização de metais e acessórios.

Substituição de box e elementos de vidro.

Nova pintura com paleta mais atual.

Revisão de portas e ferragens.

Essas melhorias, quando bem executadas, podem aumentar a percepção de valor do imóvel sem exigir obras complexas.

Cuidados importantes em reformas de apartamento

Quem mora em condomínio precisa observar regras específicas. Ignorar isso pode gerar multas ou até embargo da obra.

Os pontos mais comuns incluem:

- horário permitido para obra

- necessidade de ART ou RRT

- proteção das áreas comuns

- controle de ruído

- comunicação prévia ao síndico

Verificar essas exigências antes de iniciar evita conflitos desnecessários.

Quando vale contratar um engenheiro ou arquiteto

Muita gente tenta economizar conduzindo a reforma por conta própria. Em obras muito simples, isso pode funcionar. Mas em intervenções mais técnicas, o apoio profissional tende a compensar.

Vale considerar a contratação quando houver:

- alterações de layout

- mudanças hidráulicas ou elétricas relevantes

- integração de ambientes

- reforma completa de cozinha ou banheiro

- dúvidas estruturais

Além de reduzir riscos, o acompanhamento técnico costuma gerar melhor aproveitamento de espaço e materiais.

Um bom começo faz toda a diferença

Reformar não precisa ser sinônimo de dor de cabeça. Com planejamento cuidadoso, escolha correta de profissionais e controle financeiro desde o início, a obra tende a fluir de forma muito mais tranquila.

O ponto principal é evitar decisões por impulso. Pesquisar fornecedores, definir prioridades e organizar cada etapa antes de começar costuma ser o que separa uma reforma bem-sucedida de uma cheia de imprevistos.

Se a preparação for bem feita, mesmo uma pequena reforma pode gerar um resultado expressivo, valorizando o imóvel e melhorando o conforto no dia a dia.

Mais Lidas

LIDE promove debate sobre o cenário político brasileiro com presença estratégica do Grupo Sogno

O evento “Cenários do Brasil”, realizado no Hotel W em São Paulo, reuniu lideranças empresariais como o grupo SOGNO e...

USA Equity Summit conecta empresários brasileiros a oportunidades estruturadas nos Estados Unidos com destaque para Lucio Santana

Empresários e investidores brasileiros que desejam expandir, proteger e internacionalizar seu patrimônio terão um ambiente estratégico de decisão no USA...

O que fazer se um pedido de um site internacional demorar ou não chegar?

Compras em sites internacionais tornaram-se cada vez mais comuns, impulsionadas por preços competitivos e pela grande variedade de produtos disponíveis....

Reforma de apartamento: por onde começar para evitar dores de cabeça

Reformar um apartamento pode valorizar o imóvel, melhorar o conforto e até reduzir custos de manutenção no longo prazo. O...

Belo Horizonte vira o epicentro do mercado imobiliário brasileiro por três dias

(Edição 2026 do evento recebe os principais nomes do setor imobiliário brasileiro. Foto: Equipe Squad) Evento reúne cerca de 250...

ArPa 2026 confirma galerias e artistas do Setor Principal

(Imagem da vista geral do Setor Principal da edição de 2025 da ArPa Feira de Arte. Foto: Taurina Filmes) Quinta...

É HOJE! School of Rock realiza Rock Talks para apresentar modelo de franquia a investidores

Evento destaca expansão da rede no Brasil e oportunidades no mercado de franquias educacionais A School of Rock, maior rede...

Aplicativo propõe reeducação sexual consciente com foco em autoconhecimento e saúde íntima

Plataforma digital utiliza conteúdos educativos e práticas inspiradas no tantra para estimular consciência corporal e desempenho saudável O debate sobre...

Sapatos de luxo no Brasil: como o calçado certo fortalece imagem, autoridade e posicionamento

No universo da moda masculina, poucos elementos comunicam tanto quanto um sapato. Mais do que um item funcional, ele representa...

O papel dos adubos líquidos na redução de perdas por lixiviação

Adubos foliares líquidos têm se mostrado uma opção técnica eficaz para reduzir a perda de nutrientes no solo, principalmente em...

Ultimos Posts

-

Saúde4 dias ago

Saúde4 dias agoQuando formar médicos vira risco

-

Entretenimento7 dias ago

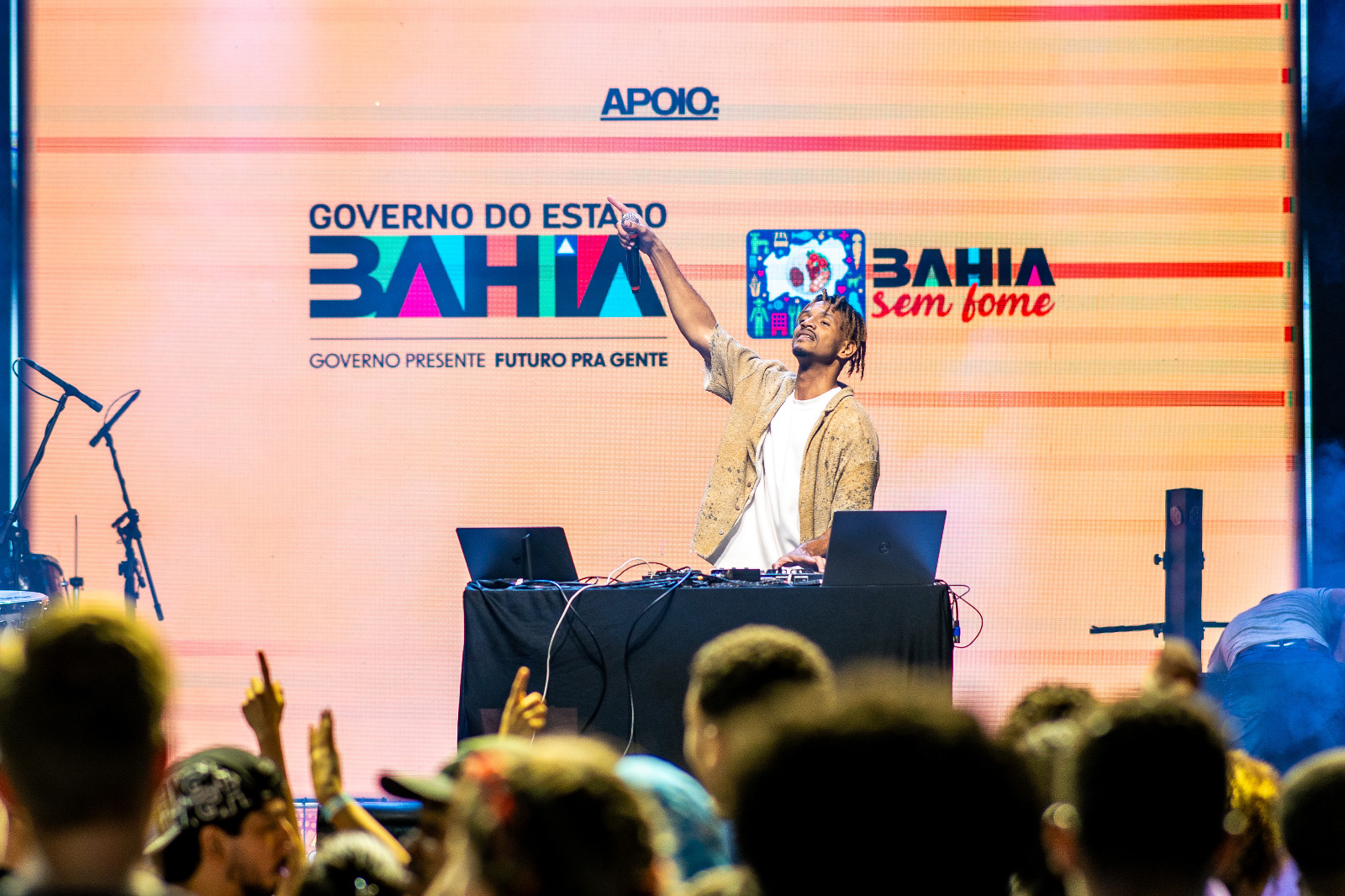

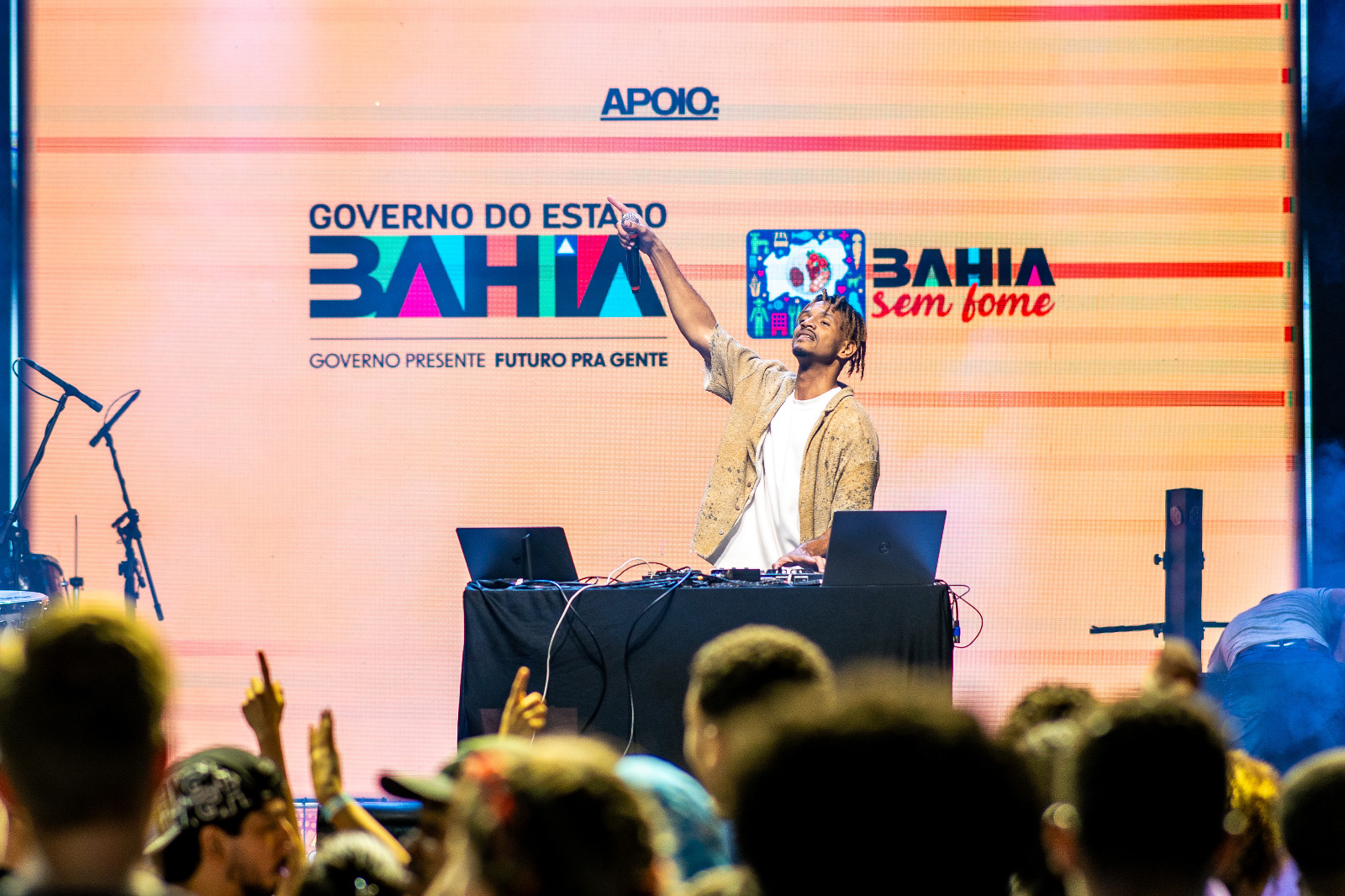

Entretenimento7 dias agoDJ carioca Bruninho Music faz a festa no penúltimo dia do Impacto de Carnaval – Sal da Terra 2026 no Centro de Salvador

-

Saúde5 dias ago

Saúde5 dias agoDiástase: o que ninguém te conta sobre recuperar sua barriga e sua autoestima-Por Carine Trindade

-

Saúde5 dias ago

Saúde5 dias agoAlta tecnologia promete resultados rápidos no combate à alopecia, aponta especialista

-

Geral6 dias ago

Geral6 dias ago5 restaurantes com vista para o mar para transformar o happy hour em experiência

-

Celebridades4 dias ago

Celebridades4 dias agoDo primeiro desfile ao Desfile das Campeãs: Alisha celebra sua evolução no carnaval

-

Geral4 dias ago

Geral4 dias ago5 fatores que aumentam a produtividade na colheita mecanizada de madeira

-

Geral4 dias ago

Geral4 dias agoO papel dos adubos líquidos na redução de perdas por lixiviação